Legal Governing Of Organizations

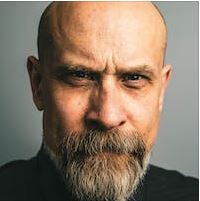

About Us

Running a successful organization or business is no small feat, and the regulatory environment can be daunting. That’s where we come in. McMahan Law Attorney is your legal partner, dedicated to helping organizations and businesses navigate the intricacies of governing law.